Ontario Tax Form 2025

Ontario Tax Form 2025 – For people with visual impairments, the following alternate formats are also available: Review ontario's 2025 federal and provincial personal income tax rates and determine your tax bracket and marginal tax rate. As an employee, you complete this form if you have a new employer or payer and will receive salary, wages, or any other remuneration, or if you wish to increase the amount of tax deducted at source. For best results, download and open this form in adobe reader.see general information for details.

Use this form to calculate your ontario tax. Td1pe 2025 prince edward island personal tax credits return Td1on 2025 ontario personal tax credits return; Do not give your filled out worksheet to your employer or payer.

Ontario Tax Form 2025

Ontario Tax Form 2025

Enter this amount on line 1 of form td1. Td1on 2025 ontario personal tax credits return. You can view this form in:.

Worksheet for the 2025 ontario. Your estimated net income for the year 2. Td1nu 2025 nunavut personal tax credits return;

Entering Personal Tax Credits and Deductions Humi Help Centre

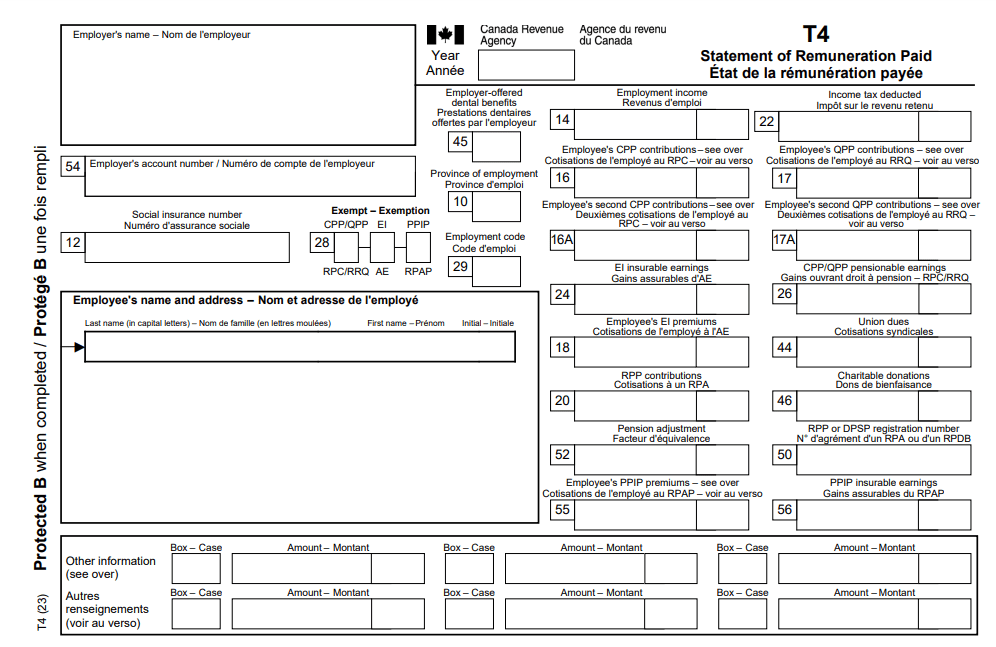

20192025 Form Canada T1261e Fill Online, Printable, Fillable, Blank pdfFiller

How to complete a 2024 TD1 Ontario YouTube

Onttaxtps Fill out & sign online DocHub

2025 Canadian Tax Deadlines Everything You Need to Know Universal Tax Professionals

20182025 Form Canada RC232 Fill Online, Printable, Fillable, Blank pdfFiller

Canada tax season Five key 2025 dates to know for filing your returns

HOW TO Fill TD1ON Form Ontario Canada (2024) YouTube

Canada Tax Guide & Deadlines Advanced Tax Services

How to fill out TD1 2025 and TD1AB 2025 YouTube

Ontario County tax levy rises 3.46 under adopted 2025 budget News

T1 general form Fill out & sign online DocHub

What you need to know about filing your taxes in 2025

Understanding the TD1 Form A Comprehensive Guide for Canadian Taxpayers

Filling out a Canadian Tax Form (T1 General and Schedule 1) using 2017 as an Example YouTube